December 13th 2023

In the latest development, the Federal Reserve made its anticipated policy announcement today, resulting in a significant decline in mortgage rates. In line with expectations, the Fed opted to maintain its policy rate without any adjustments. However, the market reaction was swift and decisive…

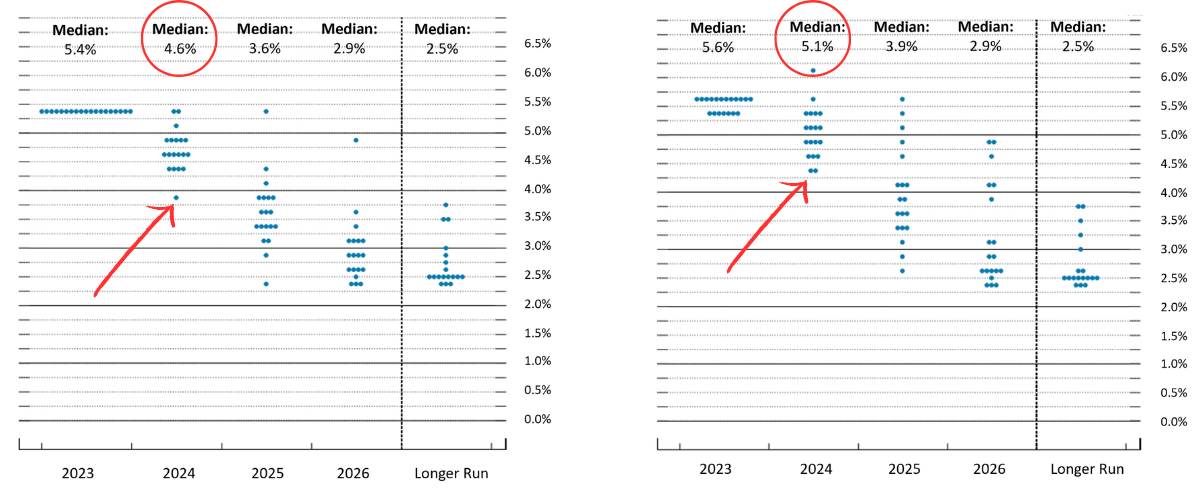

The official policy announcement did not contain any noteworthy information, as the Fed refrained from making significant statements and took a mostly neutral stance. However, they subtly hinted at the conclusion of the prevailing rate hike cycle. Since the chairman was not providing much feedback, the real focus of the day shifted to the dot plot, a tool used by the Fed to communicate its projections for the Fed Funds Rate four times a year. While the dot plot in September had unfavorable implications for rates, subsequent economic data and statements from the Fed since have suggested a more favorable outlook for today’s announcement. The dot plot from today predicted a larger decrease in rates in 2024 and 2025 than were previously expected. This caused a rapid decrease in mortgage rates to bring mortgage rates down to the lowest levels seen since May of 2023. The individual dots on the dot plot each represent the opinion of one the federal reserve representatives surveyed each quarter. Overall we see a .5% expected decrease from the previous quarter for 2024.

(4th Quarter Dot Plot on the Left and 3rd Quarter Dot Plot Left)

As the monthly press conference by Chairman Powell was taking place rates continued to drop a significant amount. Notably, during the press conference he did not object to the substantial drop in rates, indicating a tacit approval of the market’s response. This was interpreted by the market as a positive endorsement of the prevailing momentum. By the end of the trading day, the average 30-year fixed rate for a top-tier scenario had experienced a remarkable drop of nearly over 0.25% from the previous afternoon. This marks one of the most significant single-day decreases on record. The change is rates is a welcome relief for buyers that are struggling with affordability. We will continue to follow the market to see if this trend continues.

While hard money rates do not tend to be as responsive as conventional loans to the bond markets, we are certainly affected by changes in the conventional mortgage market and the economy as a whole. Particularly, we welcome an increase in affordability so that our bridge loan borrowers can find buyers for their flip properties or find takeout loans for their rental properties. In addition, more certainty and clear direction from the FED and the economy will help paint a clearer picture of the future, which is a benefit for all buyers and lenders alike.

Continue to follow Lantzman Lending for market updates, or give us a call for any of your investing loan needs….

Lantzman Lending

(858)720-0229

(858)720-0229

info@lantzmanlending.com

info@lantzmanlending.com

======> Get a quote for your next loan in minutes <=======